SOL Price Prediction: Analyzing the Path to Recovery After Recent Decline

#SOL

- Technical indicators show SOL is oversold with MACD at -1.7356 and price near lower Bollinger Band

- Mixed fundamental signals with positive ecosystem partnerships but ETF launch disappointment

- Critical $180 support level breach creates both risk and opportunity for traders

SOL Price Prediction

SOL Technical Analysis: Oversold Conditions Signal Potential Rebound

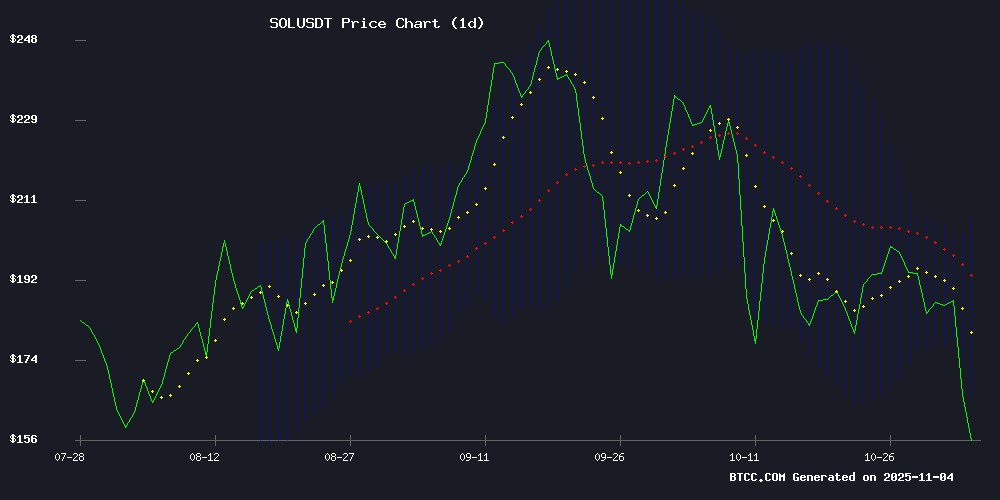

According to BTCC financial analyst Ava, SOL is currently trading at $154.99, significantly below its 20-day moving average of $186.51, indicating bearish momentum in the short term. The MACD reading of -1.7356 suggests weakening downward pressure, while the price sitting NEAR the lower Bollinger Band at $166.19 points to potential oversold conditions. The current technical setup indicates SOL is testing crucial support levels that could determine the next major price movement.

Mixed Market Sentiment Amid Solana Ecosystem Developments

BTCC financial analyst Ava notes that while the MoonPay and Pump.fun partnership represents positive infrastructure development for Solana, the recent price drop despite the BSOL ETF launch reflects underlying market concerns. The testing of critical support at $180 combined with the partnership news creates conflicting signals, suggesting traders are weighing long-term ecosystem growth against short-term price pressures.

Factors Influencing SOL's Price

MoonPay and Pump.fun Partner to Streamline Crypto Purchases on Solana

MoonPay, a leading cryptocurrency payments provider, has teamed up with Pump.fun, a Solana-based platform for instant token creation and trading. The partnership enables users to purchase crypto directly within the Pump.fun mobile app using MoonPay's payment infrastructure, which supports credit cards, bank transfers, Apple Pay, and Google Pay.

The collaboration aims to reduce friction in the Solana ecosystem by simplifying the onboarding process. Ivan Soto-Wright, MoonPay's CEO, emphasized the importance of direct access to crypto for creators and communities, praising Pump.fun as one of the most innovative platforms in the space.

To celebrate the partnership, MoonPay announced a $1,700 SOL giveaway, with ten winners to be selected on November 6, 2025. The integration marks another step toward mainstream adoption of blockchain technology by bridging traditional finance with decentralized ecosystems.

Solana Price Drops Sharply Despite BSOL ETF Launch

Solana's price tumbled to $158, breaching a critical support level between $178 and $180. The breakdown from a symmetrical triangle pattern signals bearish momentum, with the cryptocurrency now testing a historical demand zone at $155-$165.

Bitwise's BSOL ETF gathered $400 million in assets during its debut week, but failed to buoy SOL's price. Market participants are weighing whether this decline represents a buying opportunity or the start of a deeper correction.

Technical indicators present conflicting signals. A spike in four-hour Bollinger Band Width Percentile points to heightened volatility, while the daily reading of 65% suggests more stable conditions may emerge.

Solana Tests Critical Support at $180 as Traders Weigh Buying Opportunity

Solana (SOL) faces a pivotal technical moment, trading near $175 as it retests the $180 support level that has underpinned its 2025 rally. A rebound could propel prices toward $220-$250, while a breakdown may trigger a slide to $150. Elevated trading volume during the pullback suggests sustained selling pressure rather than consolidation.

The cryptocurrency's near-term trajectory hinges on whether it can defend the $180 zone—a level that has repeatedly served as springboard for upward moves this year. Market participants are closely watching for either a confirmed close above $185 to signal strength or a decisive break below $180 that would confirm bearish momentum.

Despite the 5.3% daily decline, Solana remains a focal point for traders speculating on altcoin recoveries. The network's growing ecosystem and institutional interest continue to fuel long-term bullish arguments, even as short-term technicals remain contested.

How High Will SOL Price Go?

Based on current technical indicators and market developments, BTCC financial analyst Ava suggests SOL could potentially rebound toward the $180-$190 range in the near term, representing a 16-23% upside from current levels. However, sustained movement above $200 would require stronger bullish catalysts and improved market sentiment.

| Price Level | Significance | Probability |

|---|---|---|

| $180 | Critical resistance & previous support | High |

| $190-200 | 20-day MA & psychological barrier | Medium |

| $150-160 | Current support zone | Current Range |